Federal Tax Exemption 2025

Federal Tax Exemption 2025. In 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts). The tcja provisions related to the estate tax exemption is set to sunset on december 31, 2025 — causing the exemption limits to revert to approximately $7 million.

The tcja provisions are currently scheduled to expire at the end of 2025, and the inflation adjusted estate tax exemption is anticipated to land at around $6.8. The estate tax exemption in 2024 is $13.61 million for individuals and $27.22 million for couples.

The Tcja Provisions Are Currently Scheduled To Expire At The End Of 2025, And The Inflation Adjusted Estate Tax Exemption Is Anticipated To Land At Around $6.8.

However, without congressional action, at the end of 2025, the federal estate tax exemption will be reduced to approximately $7 million per individual.

The Federal Lifetime Gift And Estate Tax Exclusion Will Increase From $12.06 Million In 2022 To $12.92 Million For 2023.

The current elevated estate and gift tax exemptions, introduced by the tax cuts and jobs act (tcja) of 2017, are set to expire on december 31, 2025.

Federal Tax Exemption 2025 Images References :

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, However, without congressional action, at the end of 2025, the federal estate tax exemption will be reduced to approximately $7 million per individual pending final. However, without congressional action, at the end of 2025, the federal estate tax exemption will be reduced to approximately $7 million per individual.

Source: www.adviceperiod.com

Source: www.adviceperiod.com

Federal Estate and Gift Tax Exemption to Sunset in 2025 Are You Ready, However, without congressional action, at the end of 2025, the federal estate tax exemption will be reduced to approximately $7 million per individual. The tcja provisions are currently scheduled to expire at the end of 2025, and the inflation adjusted estate tax exemption is anticipated to land at around $6.8.

Source: monumentwealthmanagement.com

Source: monumentwealthmanagement.com

Federal Estate Tax Exemption Sunset The Sun Is Still Up, But It’s, The tax cuts and jobs act (tcja) increased the federal estate tax threshold to $25.84 million in 2023 for married couples and $12.92 million for individuals. The federal lifetime gift and estate tax exclusion will increase from $12.06 million in 2022 to $12.92 million for 2023.

Source: www.reframewealth.com

Source: www.reframewealth.com

Never Too Early to Plan Ahead Federal Estate Tax Exemption to "Sunset, The estate tax exemption in 2024 is $13.61 million for individuals and $27.22 million for couples. 15 percent of revenues will be considered deemed income and 29 percent income tax will be applicable on it.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, But because the tcja sunsets on december 31, 2025, the. The tcja provisions are currently scheduled to expire at the end of 2025, and the inflation adjusted estate tax exemption is anticipated to land at around $6.8.

Source: www.slideserve.com

Source: www.slideserve.com

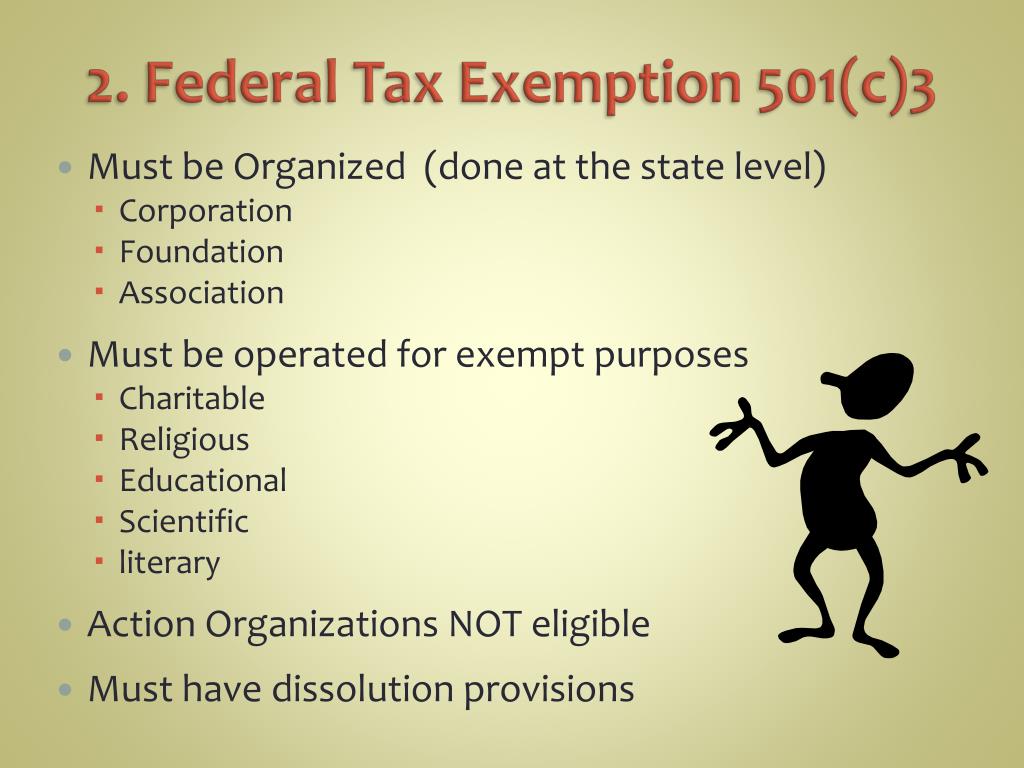

PPT Tax Exempt Status PowerPoint Presentation, free download ID6520067, 15 percent of revenues will be considered deemed income and 29 percent income tax will be applicable on it. The tcja provisions are currently scheduled to expire at the end of 2025, and the inflation adjusted estate tax exemption is anticipated to land at around $6.8.

Source: www.scotthfortney.com

Source: www.scotthfortney.com

Preparing for the Estate and Gift Lifetime Tax Exemption Sunset (2025), In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024, estimated to be $19,000 in 2025). It doubled the exemption from.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Estate Tax Exemption Amounts And Tax Rates, In 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts). The federal lifetime gift and estate tax exclusion will increase from $12.06 million in 2022 to $12.92 million for 2023.

Source: wymerbrownlee.com

Source: wymerbrownlee.com

The Federal Estate Tax Exemption Navigating the Sunset in 2025 Wymer, 15 percent of revenues will be considered deemed income and 29 percent income tax will be applicable on it. In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024, estimated to be $19,000 in 2025).

Source: www.slideserve.com

Source: www.slideserve.com

PPT Federal Tax Exemption PowerPoint Presentation, free download ID, It doubled the exemption from. The federal estate and gift tax exemption provision, a cornerstone of estate planning, is set to sunset after 2025 to its pre 2018 amount adjusted for inflation.

However, Without Congressional Action, At The End Of 2025, The Federal Estate Tax Exemption Will Be Reduced To Approximately $7 Million Per Individual.

It doubled the exemption from.

The Current Elevated Estate And Gift Tax Exemptions, Introduced By The Tax Cuts And Jobs Act (Tcja) Of 2017, Are Set To Expire On December 31, 2025.

However, without congressional action, at the end of 2025, the federal estate tax exemption will be reduced to approximately $7 million per individual.

Posted in 2025